Estate and Family Wealth Planning

Frequently Asked Questions

Why Do I Need a Family Wealth Plan?

If you have loved ones, parents, life partners, children or other family members that you would like to pass your assets and wealth on to, a family wealth plan will ensure your assets are properly distributed without costly taxes and conflict.

Who Does Springdale Law Work With?

-

Family with Assets

-

Family with Minor Children

-

Family with Kids Who Have Special Needs

-

Single People with Assets

-

Single People with No Relatives in the U.S.

-

Lesbian/Gay/Bisexual/Transgender Families

-

The Elderly and those who care for them

-

Real Estate Investors

-

Business Owners

What are the Benefits of a Family Wealth or Estate Plan?

There are many! Primarily Springdale Law Group will work with you on the following:

- Avoiding Probate Proceedings: Probate often costs your remaining family over $30,000, all taken from your estate, as well as multiple trips to court and tremendous efforts of documentation preparation.

- Your beneficiaries will inherit your assets more rapidly.

- Preventing family conflict.

- Minimizing Estate taxes

- Keeping Children and minors out of Child Protective Services

Thinking About Living Trusts

A living trust is like life insurance. Everyone knows you need health insurance, rental insurance, and car insurance. A living trust will provide you with similar protection.

Accidents happen every day and a living trust will help you plan for the unknown. We are planning to secure your future, your loved one’s future, and we want you prepared.

What Kind of Protection Do I Need?

Springdale Law Group is here to help build the best plan for you!

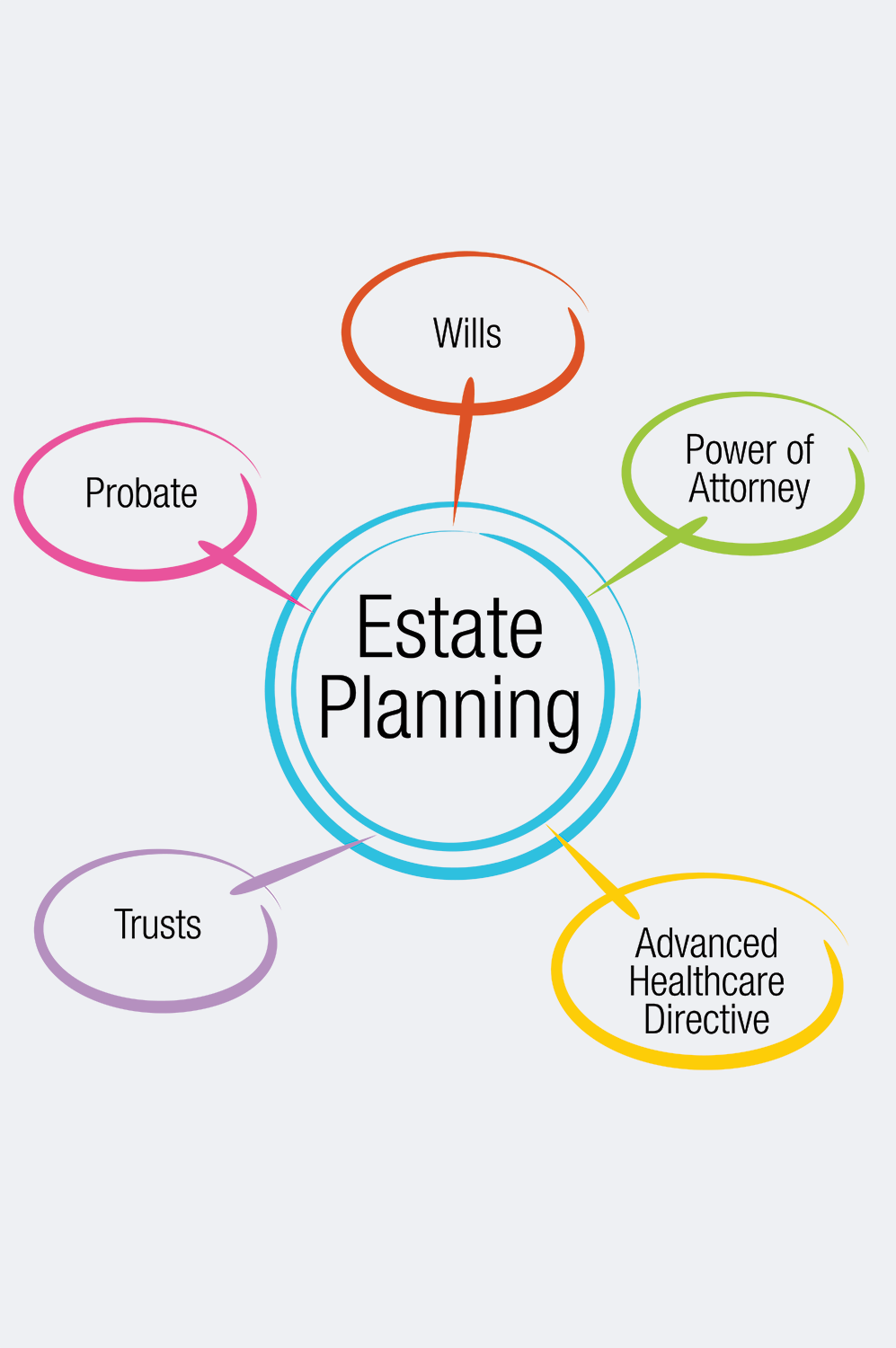

Estate planning is a general concept, and it includes forming legal documents:

-

Kids Protection Plan (includes medical power of attorney for minor)

-

Revocable Trust(s) and supporting documents

-

Irrevocable Trust(s) and supporting documents

-

Pour-Over Will(s)/Simple Will(s)

-

Complex/Testamentary Trust Will(s)

-

Financial Durable Power of Attorney(s)

-

Healthcare Document Set(s): Medical Power of Attorney, Advance Health Care Directive(s), HIPAA Release(s)

-

Healthcare Document Set(s) for Adult Children: Medical Power of Attorney, Advance Health Care Directive(s), HIPAA Release(s)

-

Owner’s Manual (including full-color diagram of plan and CD with all document

Getting Started with Estate Planning

What Makes Springdale Law Group Different?

- 1-2 Weeks Turnaround…Guaranteed!

- Flat Fee Pricing. No Surprising Fees.

- Do It Right at First Time. If you choose a simple plan, you might need to redo your plan in the near future but we respect your choice. If you choose customized plans, we walk you through all your options and assist you to plan it right for once.

- No Cookie-Cutter Plans. Well-Customized Plans That Only Fits For Your Family

- Family ID Emergency Card. All parents put this card in their wallet which includes the contact information of the children’s guardian and estate planning lawyer. In case of an emergency, the police can contact the appropriate parties quickly.

- Family Wealth Inventory List. You can effectively organize and categorize your assets, resulting in a level of organization that you may have never experienced before

- Free Review Every Three Years. Keep Your Plan Up to Date making sure your plans are still working and fit your needs considering the law is changing and your family structure might change too.

- You feel comfortable with your plan and understand each term upon signing

- Team Support. The well-trained team members will do their best to provide a response on the same day

- $0 Initial Consultation

- More than 1,000 Clients Served

- More Than 5-Star Reviews Online

-

Do you have questions about protecting your estate? Contact Springdale Law Group today.